|

Glob Reg Health Technol Assess 2022; 9: 68-72 ISSN 2283-5733 | DOI: 10.33393/grhta.2022.2366 ORIGINAL RESEARCH ARTICLE |

|

Analysis of the evolution of the price of oncology drugs after the loss of their patent and the marketing of generic medicines

ABSTRACT

Background and research question: Loss of exclusivity of oncology drugs causes an important drop in their price due to the marketing of generic medicines. In this article we study how the price of certain oncology drugs evolves throughout time after the loss of their patent, both in terms of the notified price and at a level of the public tenders for the purchase of medicines.

Methods: The variation in the price of oral oncology drugs was assessed from the public information provided by the Interministerial Medicinal Products Pricing Committee (Comisión Interministerial de Precios de los Medicamentos, CIPM) and the data from public tenders for the purchase of medicines.

Results: The data show a significant drop in price of the medicines assessed after the expiry of their patent, both at a notified price level (70% of average drop in price in 2.6 years) and at the level of the public tenders (drops exceeding 90% in a year for the most innovative drugs).

Discussion: The drop in the price of the oncology drugs after the expiry of their patent is seen in all the medicines assessed. The trends seen allow to predict the evolution of the price of another innovative medicine that is nearing the expiry of its patent (Lenalidomide), with an expected drop in price by 90% with respect to the current price of the innovative drug.

Keywords: Generic medicines, Lenalidomide, Oncology drugs

Received: January 11, 2022

Accepted: April 29, 2022

Published online: May 13, 2022

This article includes supplementary material

Global & Regional Health Technology Assessment - ISSN 2283-5733 - www.aboutscience.eu/grhta

© 2022 The Authors. This article is published by AboutScience and licensed under Creative Commons Attribution-NonCommercial 4.0 International (CC BY-NC 4.0).

Commercial use is not permitted and is subject to Publisher’s permissions. Full information is available at www.aboutscience.eu

Introduction

Currently, cancer is the second cause of death in Spain, with 26.4% of the deceases in 2018 related to this group of diseases (112,714 deaths). Despite the alarming and high figures, the impact of these diseases decreases progressively. In fact, mortality due to cancer in Spain has been dropping steadily in the last years (1). This drop in the mortality caused by cancer is due, among other causes, to the appearance of new therapeutic innovations that allow to improve the prognosis of the oncology patients.

Patents protect and stimulate the development of new therapeutic innovations by the exclusive marketing rights provided by the protection guaranteed by the patents. Nevertheless, once this period has ended with the expiry of the patent, the price of the medicines drops because of the appearance of generic medicines (Gx). As the Spanish Generic Medicines Association (Asociación Española de Medicamentos Genéricos, AESEG) underlines, the drop in price caused by the appearance of the generic medicines and approved by the Interministerial Medicinal Products Pricing Committee (Comisión Interministerial de Precios de los Medicamentos, CIPM) fluctuates between 40% and 60% with respect to the cost of the brand drug (2). In the case of drugs for hospital use, as is the case of the oncology drugs, their purchase is carried out through a public tender process that favours competition between different suppliers (in this case, pharmaceutical companies). Tender process causes important drops in price that are greater than those seen in the approved prices notified by the CIPM.

Price drops allow to free public resources, optimising the health expenditure, therefore being able to relocate resources to other areas, so that the sustainability of the system is favoured, and the medical care improves (2).

This is especially relevant in the field of oncology, as highlighted in a recent study by Cheung et al (3). This study concludes that oncology generic medicines could significantly modify the cost-effectiveness and cost-utility ratios of the studied treatments.

The objective of this report is to analyse the influence of the generic medicines on the evolution of the price of oral oncology drugs after the loss of exclusive marketing rights, with the aim of showing the impact of generic medicines on the drop in price of oncology drugs and, therefore, on the drop in price of oncology treatments, in a quick and powerful way. Likewise, we look for the identification of trends in these drops in price that allow assessing the evolution in the price of oral oncology treatments that are nearing the end of their exclusive marketing rights period.

Methodology

Selection of drugs

With the intention of delimiting the analysis to a manageable sample size, oral oncology treatments, recommended for monotherapy or in combination with other drugs, whose patent had expired and that have generic medicines in the market, so there is a price competition that allows to see its evolution after the loss of their exclusive marketing rights, were chosen.

According to the previously mentioned criteria and using the BotPlus drug databases and the Medicine Online Information Centre (Centro de Información Online de Medicamentos, CIMA) of the Spanish Agency of Medicine and Medical Devices (Agencia Española de Medicamentos y Productos Sanitarios), we have selected the eight following drugs: Vinorelbine, Capecitabine, Imatinib, Pemetrexed, Erlotinib, Dasatinib, Gefitinib and Everolimus.

Sources of information

For each of these drugs, the evolution of the “List price” (LP) and/or the tender price (TP) was analysed in the case of public tenders, using the following data sources:

• Minutes and Agreements of the CIPM: Used to decide the authorised LPs for the initial marketing of the innovative drugs (Supplementary tables S I to S IX), as well as the first authorised LP for each generic medicine. When gathering the LPs of the generic medicines, we have only borne in mind the generic medicines with the lowest LP, the presentation that provides the most advantageous economic offer.

• BotPlus: It is used for obtaining the current LPs of the different analysed drugs (both innovative and generic) as well as their marketing authorisation dates.

• Public tenders: A gathering of public tender data provided by Acobur (Advice in public health contracting) has been carried out regarding the purchase of each medicine during the years after and before the loss of the exclusive marketing rights, including tenders from hospitals and the healthcare services of different regions to ensure a representative sample.

Analysis of the evolution of the prices

From the information gathered, a double analysis was carried out. On the one hand, the variations in the LPs experienced by each drug as a function of the time passed from the LPs were approved for each generic medicine presentation. The percent decrease in the notified LP of each new generic medicine with respect to the innovative drug was calculated, and their evolution throughout time was analysed. On the other hand, the evolution of the prices obtained in the public tenders of the drugs and the TPs throughout time was analysed, focusing on the period before and after the loss of the exclusive marketing rights and the appearance of generic medicines, being therefore able to see decreases in the TPs.

Prediction of the decreases in price as a function of the trends seen

From the trends seen in this analysis, the possible evolution in the price of an oncologic drug similar to those included in the analysis, as in the case of Revlimid® (Lenalidomide), an innovative drug by Bristol Myers Squibb, whose patent expires in the first quarter of 2022 (4), will be estimated. To strengthen the prediction, we have relied on the advice of hospital pharmacists with a view to having in mind their knowledge regarding the evolution of the prices of drugs.

Results

Evolution of the LPs notified after the appearance of generic medicines

The analysis of the evolution throughout time of the notified LPs shows how the analysed drugs experience an average initial drop in price by 46%, although the drop increases with time, as we can see in Table I, with an average maximum decrease in the notified LP by 70% in an average interval of 2.6 years.

There is not a homogeneity in the decreases in the LPs seen in each of the analysed drugs, and we can find very dissimilar cases, such as that of Imatinib, that reaches a drop by 97% in 4.6 years, versus the rapid drop in the notified LP of Gefitinib of 84% in 1.1 years.

The fact that the four most recently approved drugs (Erlotinib, Dasatinib, Gefitinib and Everolimus) experience a drop in their LP greater than 65% in 1 year must be highlighted. The data suggest that the process of the drop in the LP as a consequence of the marketing of generic medicines has accelerated in the last years, both in terms of magnitude and time (an average of 1.3 years to reach the maximum drop versus the 3.8 years in the group of older drugs).

The presented data show how the marketing of generic drugs after the loss of the patent of the innovative medicine causes a decrease in the notified LP of the analysed oncologic drugs. Nevertheless, the hospital medicines are purchased through public tenders in which the LP only acts as a guide and a maximum price ceiling. This entails that the decrease in the TP due to the competition between pharmaceutical companies can be, in real-world conditions, much lower than the notified LP.

| Drug | Patent expiration Date | First descent notified LP | Maximum descent notified LP | Years to minimum LP |

|---|---|---|---|---|

| Vinorelbine | Not available | −37% | −56% | 4.3 |

| Capecitabine | 14/12/2013 | −39% | −68% | 1.9 |

| Imatinib | 01/12/2016 | −40% | −97% | 4.6 |

| Pemetrexed | 10/06/2021 | −40% | −45% | 4.4 |

| Erlotinib | 01/03/2020 | −42% | −74% | 1.1 |

| Dasatinib | 01/11/2019 | −69% | −70% | 1.3 |

| Gefitinib | 01/09/2019 | −40% | −84% | 1.1 |

| Everolimus | 17/01/2019 | −58% | −66% | 1.7 |

LP = list price.

Evolution of the TPs in public tenders after the appearance of generic drugs

As previously highlighted, the analysed drugs are medicines used in hospitals. Their purchase is carried out through tenders that, due to their own nature, generate a competition between pharmaceutical companies when presenting an offer that results in a price war, being the TP, and not the LP, the price paid by the healthcare centres.

The evolution of the TPs has been analysed after the loss of the exclusive marketing rights of the following drugs: Capecitabine, Imatinib, Erlotinib, Gefitinib and Everolimus. The analysis of the tenders in the case of Dasatinib and Pemetrexed could not be carried out due to the recent loss of their patent, this preventing the generic medicines pharmaceutical companies from being able to participate in public tenders when this study was carried out. It was also not possible to study the evolution of the TP of Vinorelbine after the loss of its exclusive marketing rights. Vinorelbine lost its exclusive marketing rights in 2009 and the database used to obtain the information regarding tenders only provides information from 2010. Therefore, the study of these data does not allow to see the real drop in price after the marketing of generic medicines.

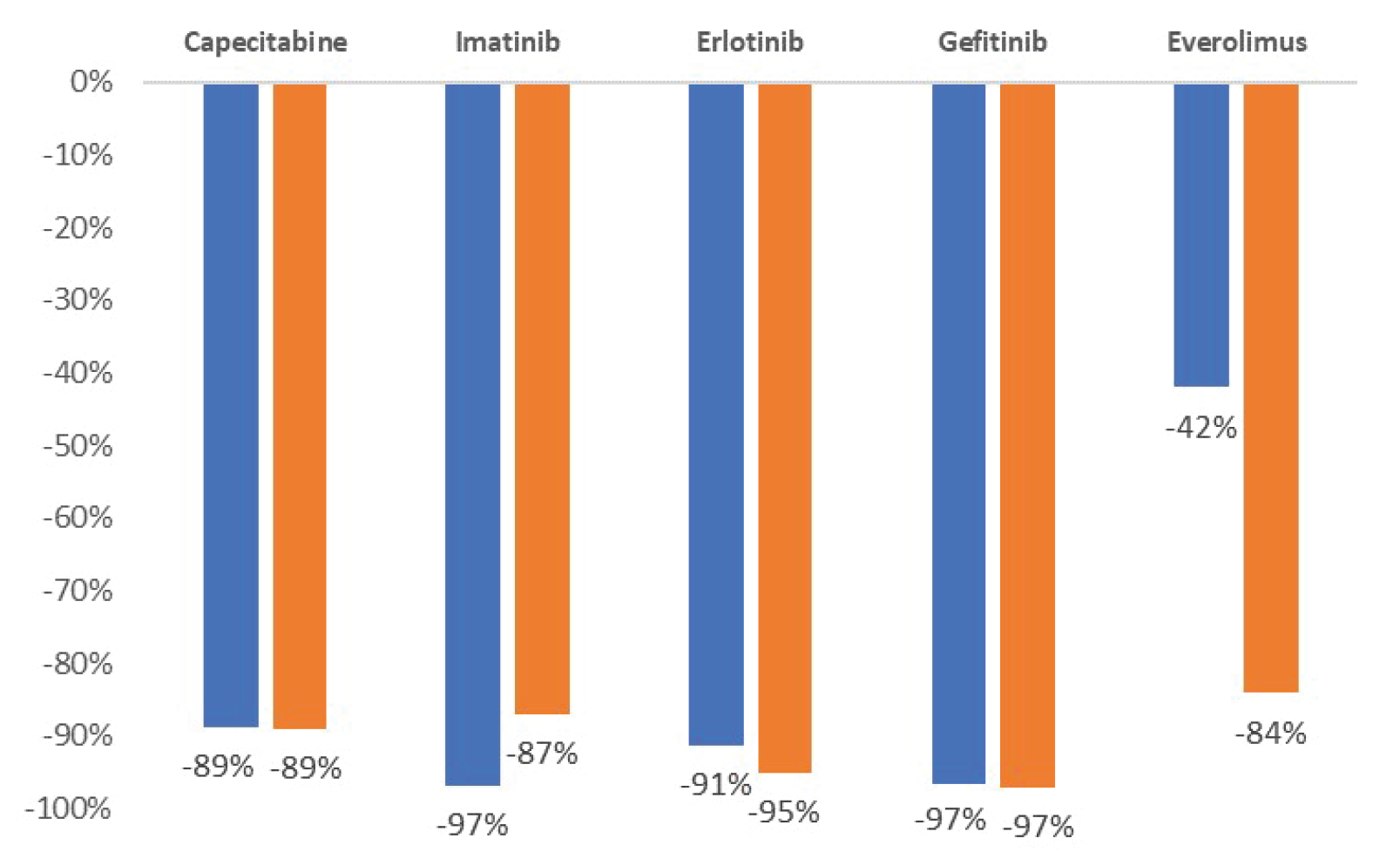

The analysis of the tenders of the most innovative oncology drugs (excluding chemotherapy, as in the case of capecitabine) shows two differentiated trends (Fig. 1). Everolimus dropped its TP by 42% versus LP in the first year after the loss of its patent. This could be due to this drug only losing its exclusive marketing rights regarding the indications of advanced breast cancer and neuroendocrine tumours but not in renal cell carcinoma. Nevertheless, this effect disappears after the first year, with a drop of 85% in TP versus LP during the second year after the partial loss of its exclusive marketing rights.

Fig. 1 - Drops in the tender price in public bids experienced by the analysed oncologic drugs during the first (blue bars) and second (orange bars) years after the loss of the exclusive marketing rights.

Imatinib, Erlotinib and Gefitinib present common trends (Fig. 1). These three drugs experience a drop in their TP greater than 90% versus LP in the first year after the loss of their exclusive marketing rights. Capecitabine, another analysed drug, dropped its TP by 89% versus LP after its first year without exclusive marketing rights (Fig. 1). Nevertheless, because it is a chemotherapeutic treatment, it is considered that it must be analysed separately from Imatinib, Erlotinib and Gefitinib.

All the assessed drugs experience a pronounced and significant drop in their TP after the loss of the exclusive marketing rights, in a period of 1 year, decreases exceeding 80%, reaching figures above 90% in innovative drugs. Because of this, it seems that the savings in costs generated by the marketing of generic medicines are even higher than that deduced from the notified LPs.

Prediction of the evolution of the price of Revlimid® (Lenalidomide)

As mentioned in the methodology section, the analysed data and price trends allow to estimate the LP of other drugs that are nearing the marketing of generic medicines, as in the case of Revlimid® (Lenalidomide), by BMS, whose patent expires in the first quadrimester of 2022 (4). This drug is recommended for the treatment of oncohaematologic disorders such as multiple myeloma, mantle cell lymphoma and follicular lymphoma, as well as myelodysplastic syndromes, reaching in 2020 global sales for USD12,100 million. Revlimid® will lose its exclusive marketing rights in March 2022.

There are currently 20 Lenalidomide generic medicines authorised in Spain; 14 of these 20 Lenalidomide generics have an approved LP (Tab. II), and therefore they would be ready for their marketing after the loss of the exclusive marketing rights. Five generics with a decrease of –59% and the other generics show a notified LP that is 65% lower than the LP notified for the innovative medicine Revlimid®. It should be noted that in some cases, such as Reddy’s Pharma, it has requested a voluntary reduction in its generic medicine price, going from the initial –59% to –65%. In case of not changing the LP of Revlimid® until the loss of the exclusive marketing rights, these data entail a great decrease in the LP that is greater than that seen in other analysed drugs.

In the case of the drug tenders, it is reasonable to predict that Lenalidomide will follow the same pattern seen in other analysed oncologic drugs, with a decrease in their TP by 90% during their first year of marketing as generic medicines. Hospital pharmacists consulted on the expected trend of Lenalidomide in drug tenders have stated that it is expectable that the TP of Lenalidomide in tenders decreases by approximately 75%, at least with respect to its current price, in the first year.

| Drug type and company | CIPM date | Marketing authorisation date | CIPM LP (€/mg)* | Interval since 1st Gx LP approval by CIPM (years) | Price difference vs innovative price | Price difference vs 1st Gx LP |

|---|---|---|---|---|---|---|

| Innovative (BMS) | 25/05/2007 | 14/06/2007 | 11.518 | NA | NA | NA |

| Generic 1 (Cipla) | 14/10/2020 | 10/03/2020 | 4.678 | 0 | −59% | NA |

| Generic 2 (Accord) | 28/02/2021 | 27/11/2020 | 4.678 | 0.4 | −59% | 0% |

| Generic 3 (Reddy Pharma) | 01/12/2020 | 01/12/2020 | 4.678 | 0.1 | −59% | 0% |

| Generic 4 (Stada) | 27/11/2020 | 20/03/2021 | 4.678 | 0.1 | −59% | 0% |

| Generic 5 (Kern) | 31/03/2021 | 01/10/2020 | 4.678 | 0.5 | −59% | 0% |

| Generic 6 (Krka) | 31/05/2021 | 20/03/2021 | 4.678 | 0.6 | −59% | 0% |

| Generic 7 (Viso) | 30/06/2021 | 09/02/2021 | 4.678 | 0.7 | −59% | 0% |

| Generic 8 (Teva) | 31/07/2021 | 01/08/2019 | 4.678 | 0.8 | −59% | 0% |

| Generic 9 (Fresenius) | 31/10/2021 | 09/02/2021 | 3.977 | 1.0 | −65% | −15% |

| Generic 10 (Mylan) | 31/10/2021 | 25/06/2021 | 3.977 | 1.0 | −65% | −15% |

| Generic 11 (Sandoz) | 31/10/2021 | 09/02/2021 | 3.977 | 1.0 | −65% | −15% |

| Generic 12 (Aurovitas) | 30/11/2021 | 01/10/2021 | 3.977 | 1.1 | −65% | −15% |

| Generic 13 (Sun) | 31/12/2021 | 01/10/2021 | 3.977 | 1.2 | −65% | −15% |

| Generic 14 (Tarbis) | 31/12/2021 | 01/09/2020 | 3.977 | 1.2 | −65% | −15% |

* In the case of the innovative drug, the LP indicated is the one prior to the marketing of the f irst generic, not the initial LP.

CIPM = Comisión Interministerial de Precios de los Medicamentos; Gx = generic medicines; LP = list price.

Conclusions

The data analysed in this study show that the marketing of generic medicines causes a significant drop in the notified LP of the drug. This drop is especially quick in the TP of the bids, that experience a fall by 90% in a year with respect to the LP of the innovative drug.

In 2022, Lenalidomide (Revlimid®), whose global invoicing was USD12,100 million, will lose its patent. There are already nine approved generic medicines with an LP 65% lower than that of Revlimid®. Voluntary drops such as that applied by Reddy’s Pharma in its generic could suggest a rapid drop in the price of generic Lenalidomide due to competition between different laboratories.

The analysis carried out in this report of tenders of generic oral oncologic drugs together with the interviews made to hospital pharmacists allow to consider that the marketing of generic Lenalidomide medicines will entail a drop by 90% in the LP of Revlimid®.

Disclosures

Conflict of interest: The authors declare no conflict of interest.

Financial support: This research has been possible thanks to Incyte Biosciences Iberia, which has financed the project and the publication of the manuscript.

Authors contribution: All authors contributed equally to this manuscript.

References

- 1. SEOM. Las cifras del cáncer en España 2020. Soc Española Oncol Médica. 2020;1. Online (Accessed January 2022).

- 2. AESEG. Ventajas de los Medicamentos Genéricos. Online (Accessed January 2022).

- 3. Cheung WY, Kornelsen EA, Mittmann N, et al. The economic impact of the transition from branded to generic oncology drugs. Curr Oncol. 2019;26(2):89-93. CrossRef PubMed

- 4. Bristol-Myers settles Revlimid patent suit with India’s Cipla. S&P Global Market Intelligence. Online